For many across the region, Carousell has established itself as the go-to portal to buy stuff, and, let’s be honest here – get rid of stuff. If you’re looking to free up space, or need to pass on your used wares, Carousell is the place to go.

But along with the desire to hawk wares comes the the ugly side of transacting, filled with lowballers and no-shows. Mismatched expectations are all part of the Carousell experience, and realising that this negativity could put a damper on growth, the Singapore start-up has introduced the option to become the escrow, or “middle-man”, with their new CarouPay feature.

The premise is simple – Carousell handles all the money side of things and all sellers need to do is list up the item, and ensure that the item is sent out on time. As the platform grows and more transactions happen, Carousell is looking to offer more safety and peace of mind when transacting on Carousell. CarouPay has been created to serve this specific need especially when higher value items are starting to get listed on the platform.

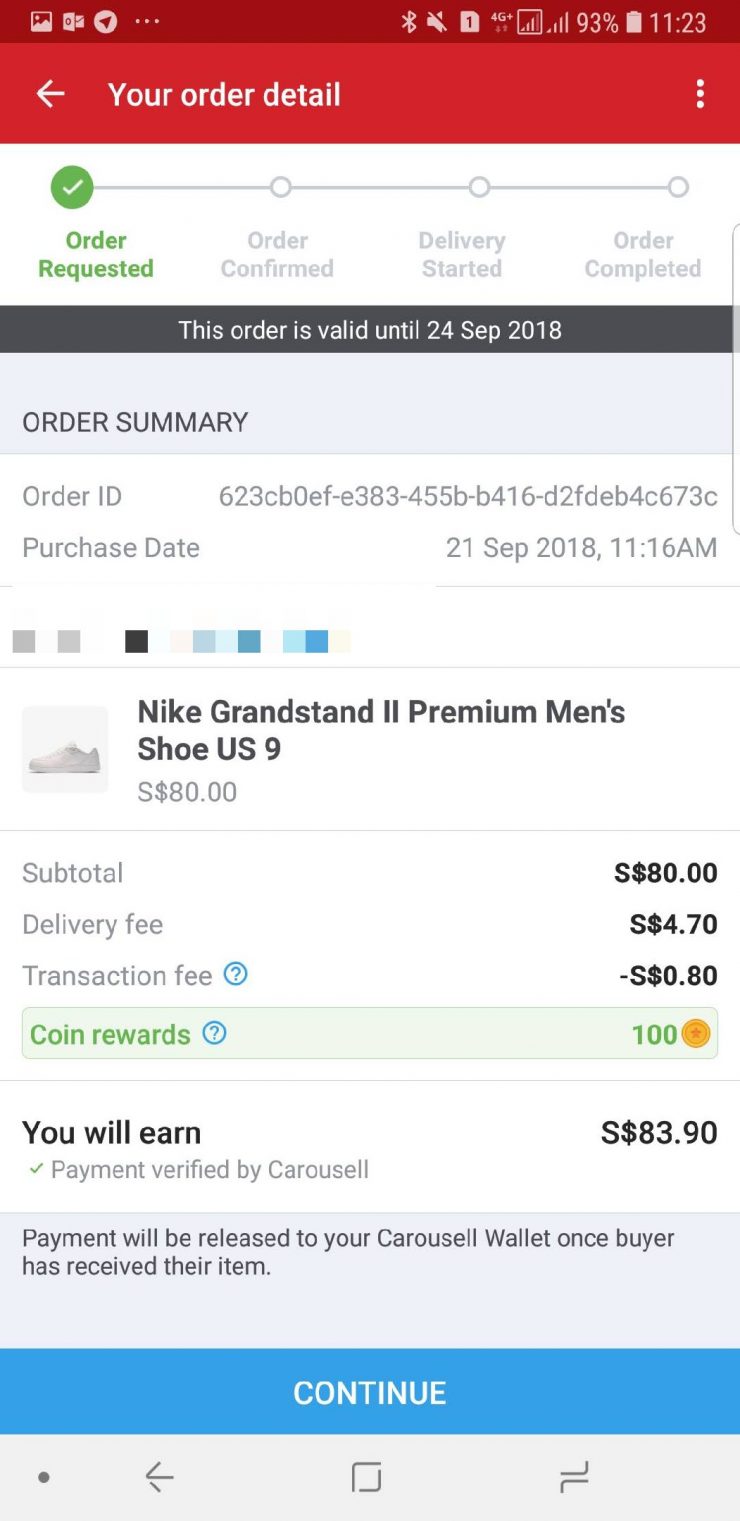

Between the time of purchase of a product by a buyer, a seller has three days to send out an item. Payment is then held by Carousell and released to seller’s Wallet after the buyer has received the item or 7 days after delivery is dispatched.

In the event of a dispute, be it on either side of a transaction, Carousell prefers for folks to try and resolve the issue amicably. Otherwise, Carousell will then step in to mediate and even refund buyers if the issue cannot be resolved as the last resort through CarouPay Protection. This happens when –

- Item not received

- Item not as listed

- Item is of a different variation, such as size, colour, model or version

- Item is incomplete or has missing parts

- Item is damaged or there is one or more undisclosed defect(s)

All things considered, CarouPay is shaping itself as a buyer-friendly platform, giving folks a piece of mind when shopping on the platform pretty much at no risk. Looking at the terms and conditions, it would appear that there are even no caps to the refund amount.

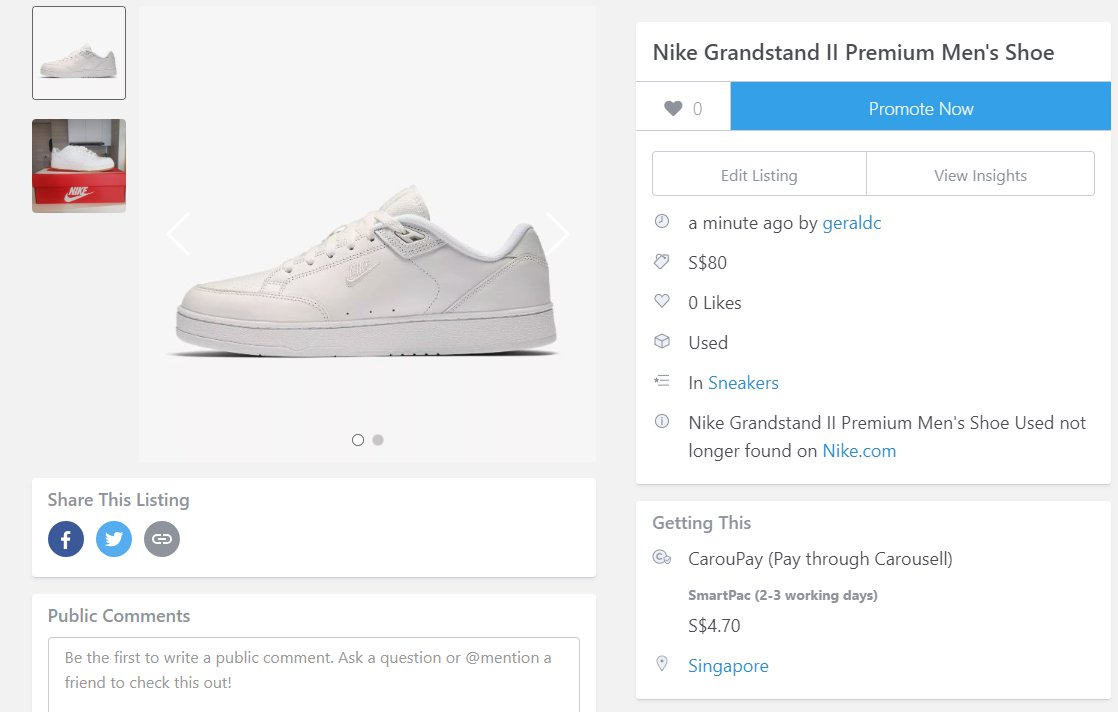

While I’ve been trying to look out for decent first purchase on the platform, my first encounter with CarouPay was as a seller, trying to sell my new pair of Nike shoes that didn’t quite fit.

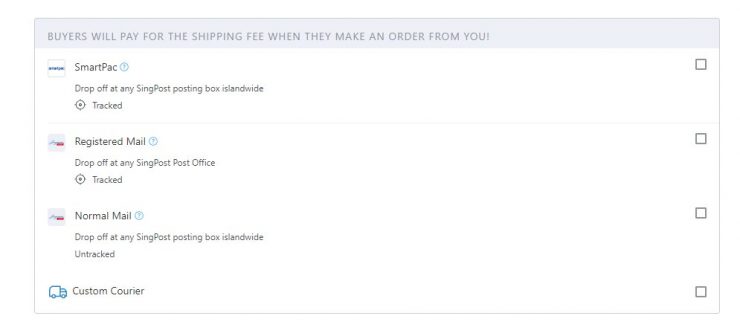

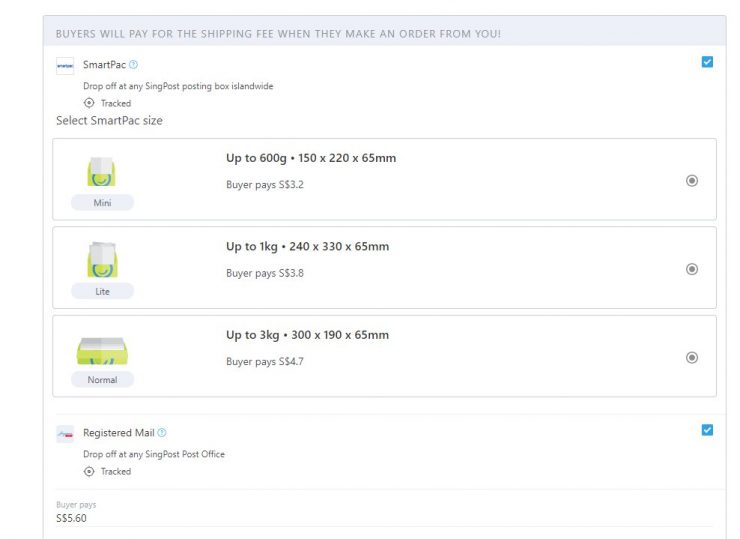

The Carousell listing process has not changed, and sellers simply opt to accept payment by CarouPay. It’s no different from listing a product on eBay and the like, but the most important thing here would be to accurately estimate how much the shipping costs be. Based on the transaction experience, Carousell, and CarouPay, will complete the transaction based on whatever shipping costs is stated in a seller’s listings, so a seller can’t back out or adjust the shipping rates unless they cancel the listing and relist the item once again.

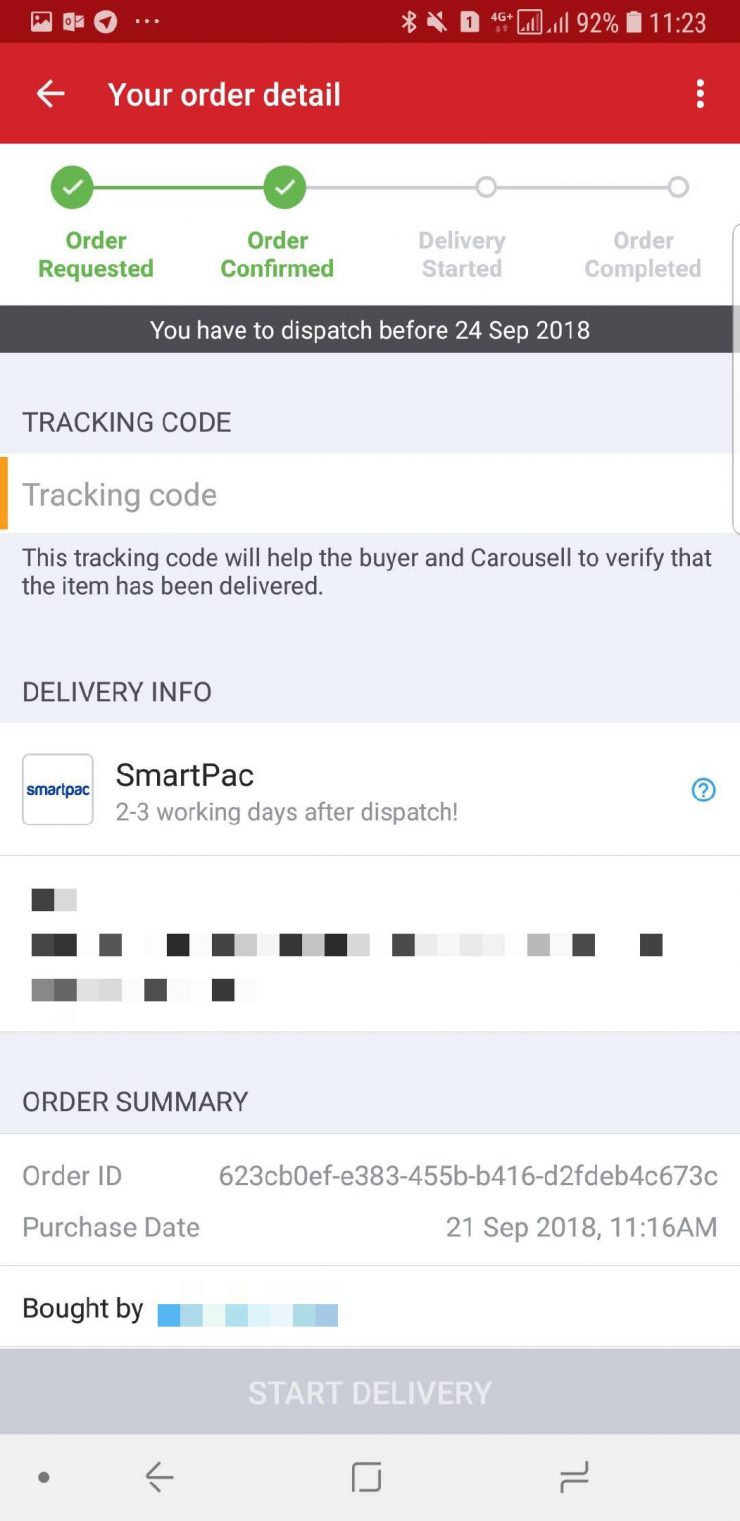

Shipping via tracked services is mandatory, thus avoiding any instance that a missing package will become a point of dispute.

Another point to note here are the transaction fees to use the CarouPay platform. By default, transaction fees are 4.98% + S$0.50 of the listed price. To some, this figure might be rather prohibitive, but for this transaction window, the fee was only 1%, which is a really small price to pay for the convenience.

Having worked at an e-commerce setup in the past, the rush of getting a successful sale is pretty awesome, and Carousell looks to be guiding sellers every step of the way. Once a sale is made, users will get an alert via email and through the app. Still, this might become rather spammy for folks who are using Carousell as their storefront.

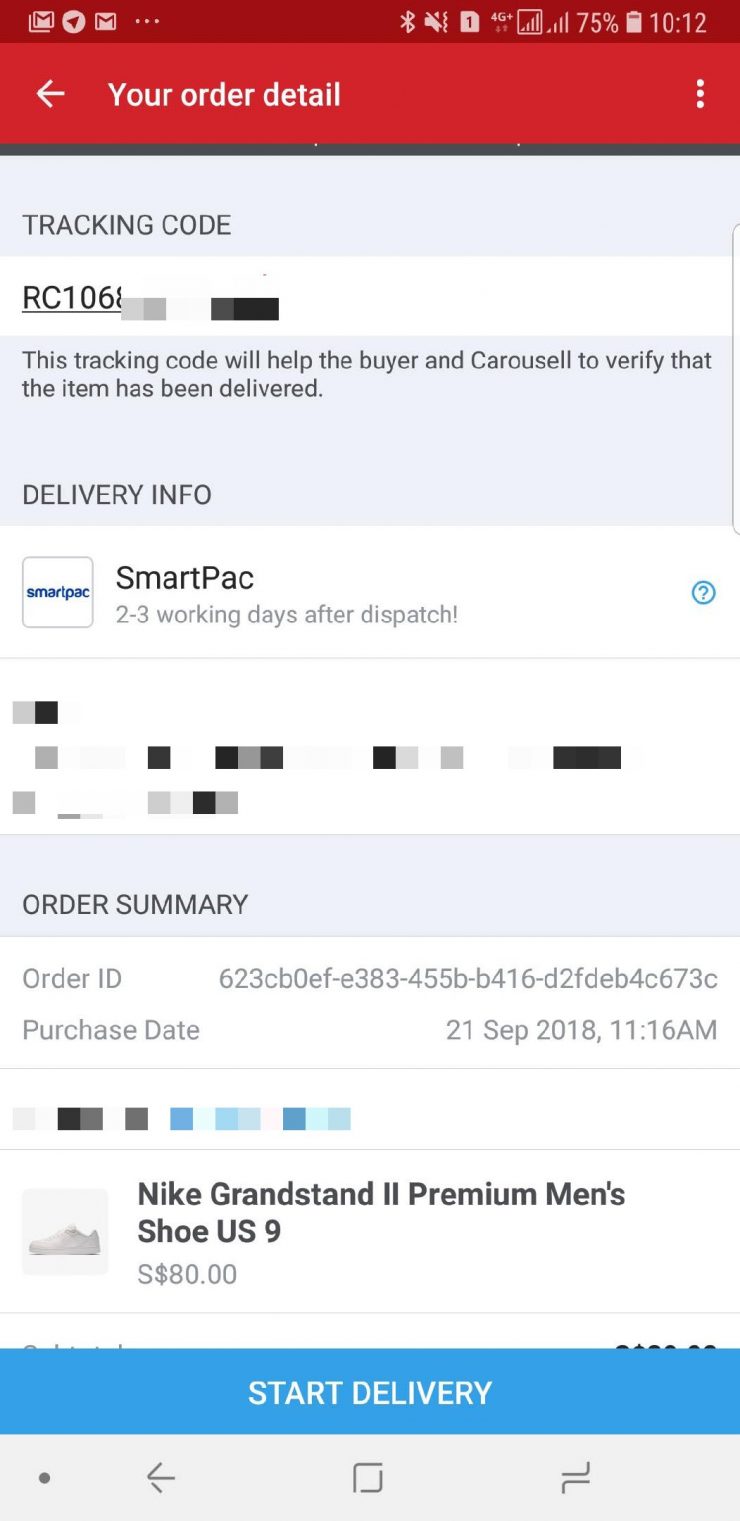

Sellers have to ship out the item within three days which is actually pretty generous. When you’ve shipped out an item, sellers will key in the tracking code as well. The level of handholding is pretty comprehensive. Thus, the waiting game for the item to arrive within the hands of the buyer starts.

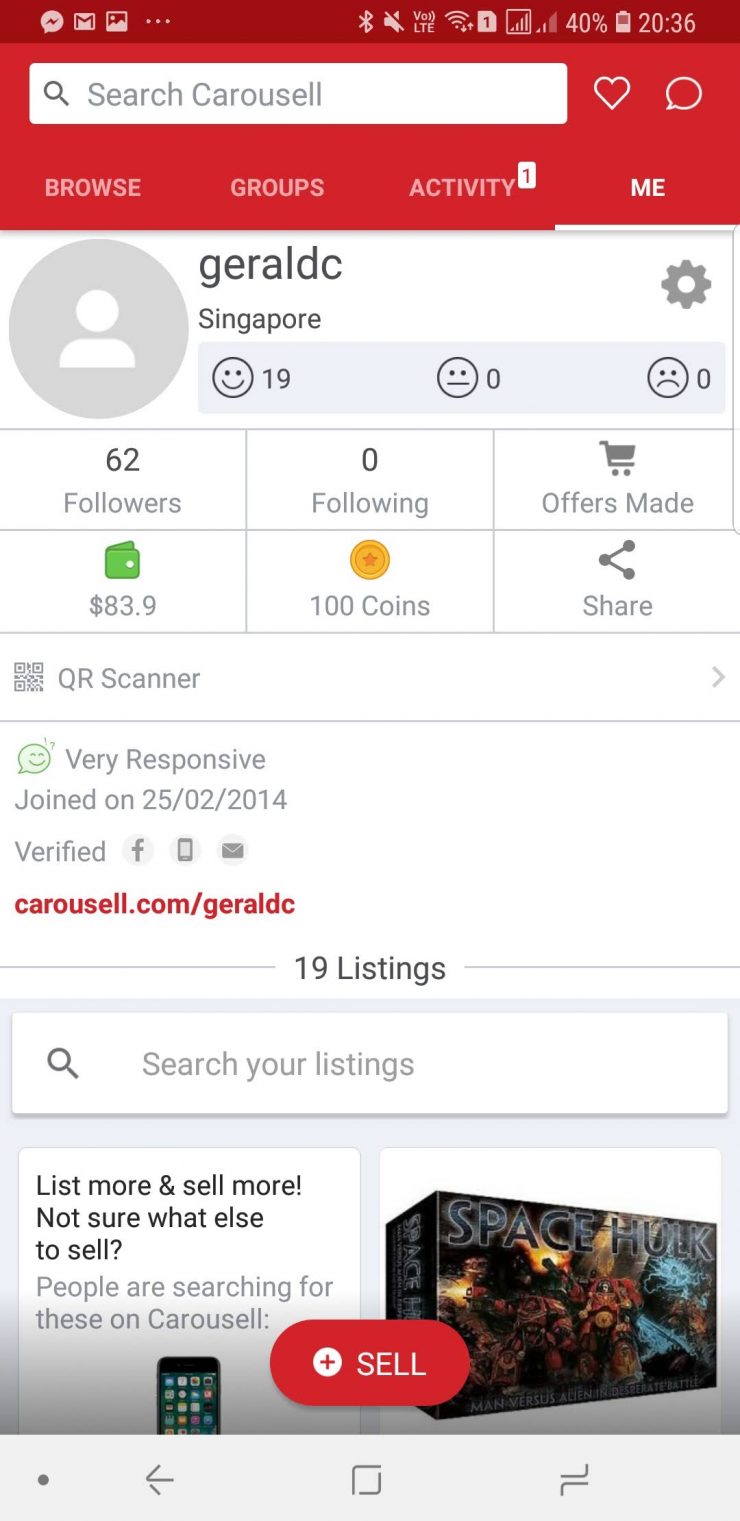

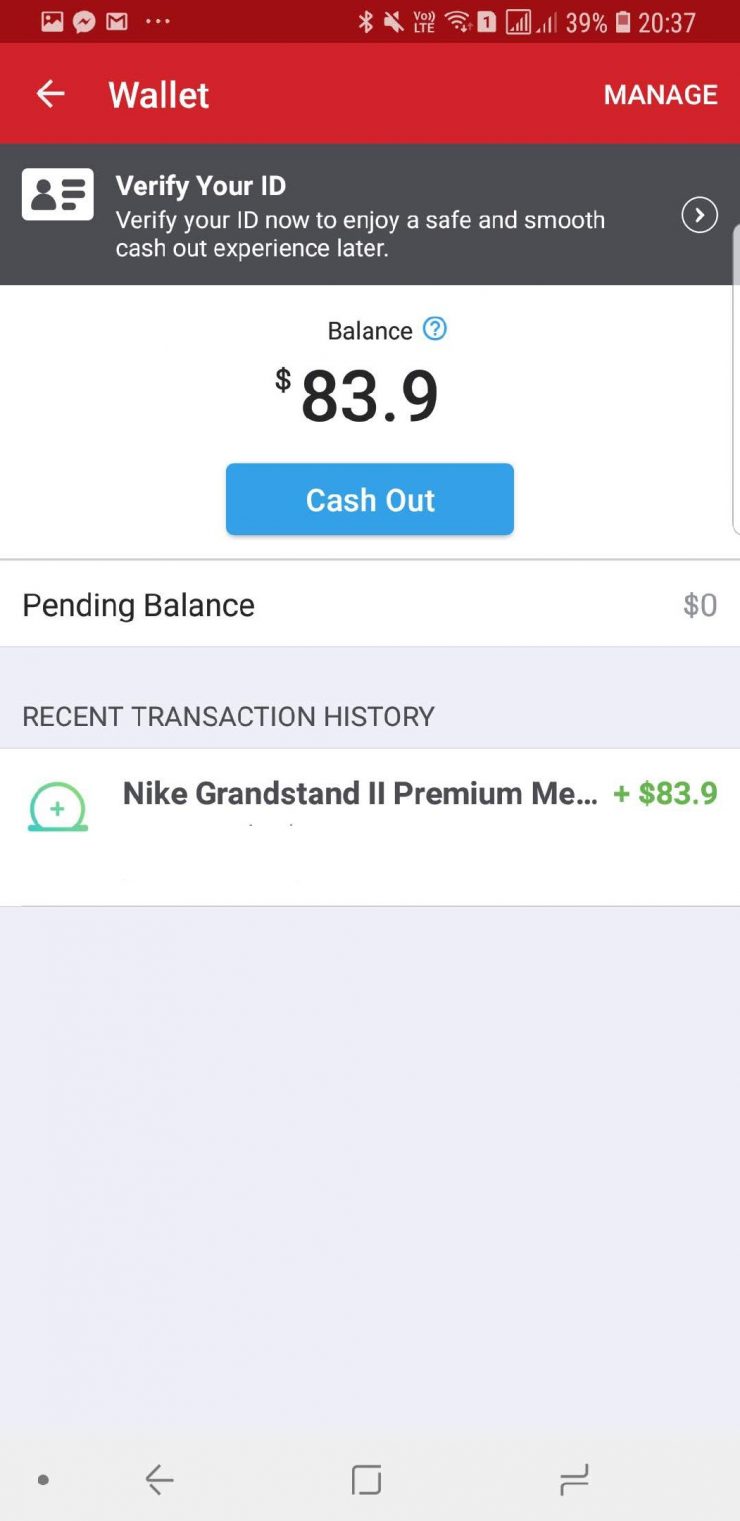

At this point, it becomes a waiting game, for the buyer to acknowledge the receipt of goods. Even if they do not, once seven days have lapsed, the funds will still be channelled into my wallet.

The entire transaction would have appeared to have gone entirely without a hitch and that’s a good thing!

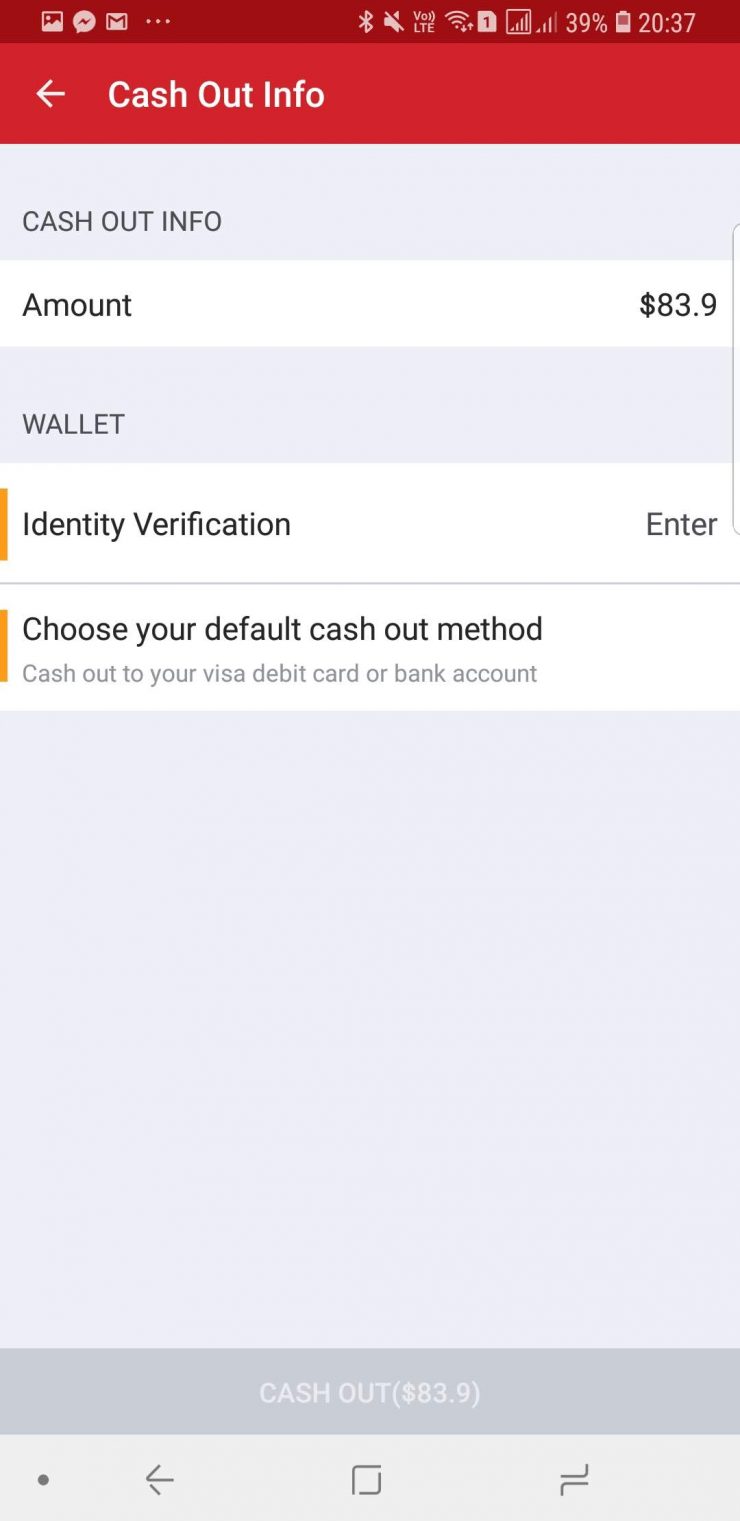

An entire transaction could take up to two weeks to complete, and the final piece of the puzzle now would be to actually withdraw the money Carousell has deposited within the e-wallet.

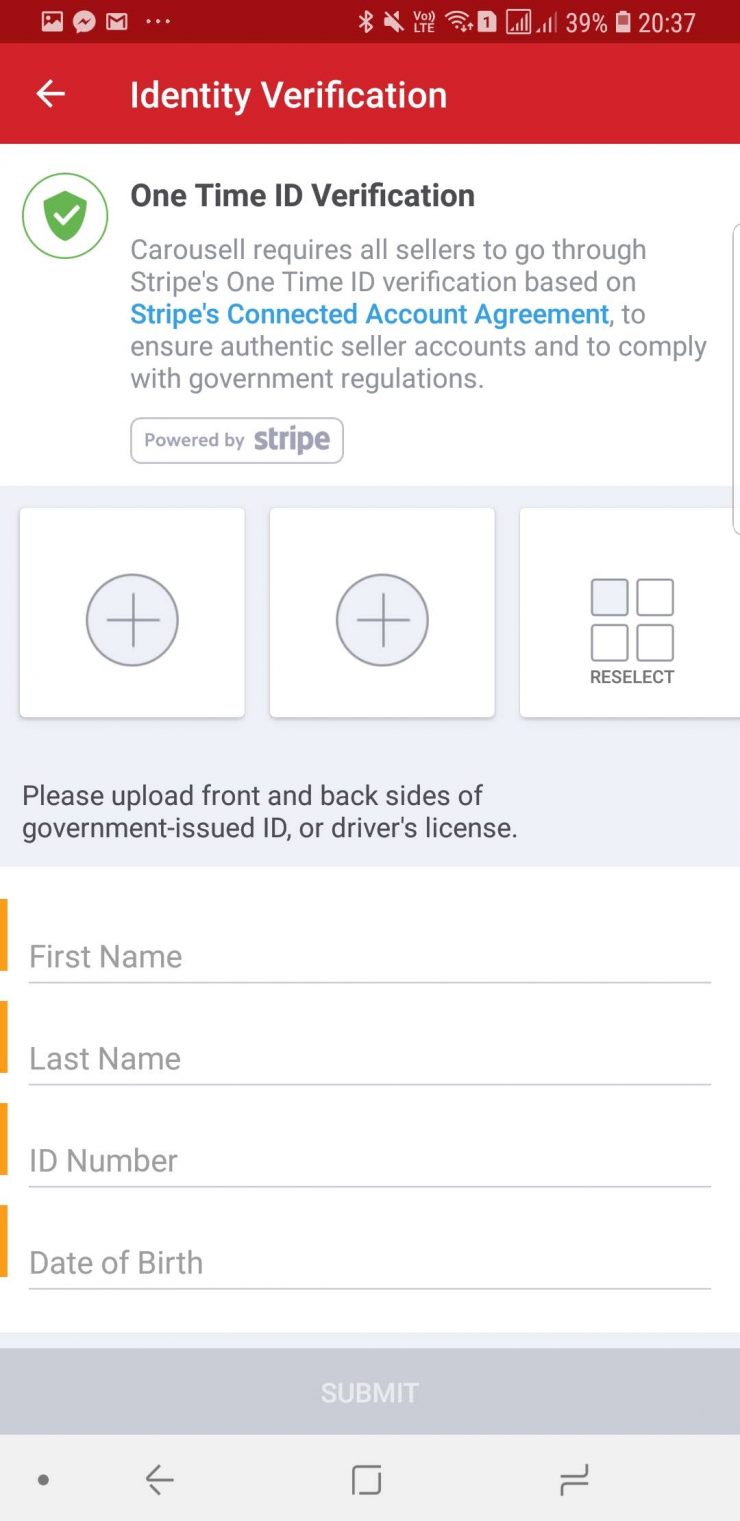

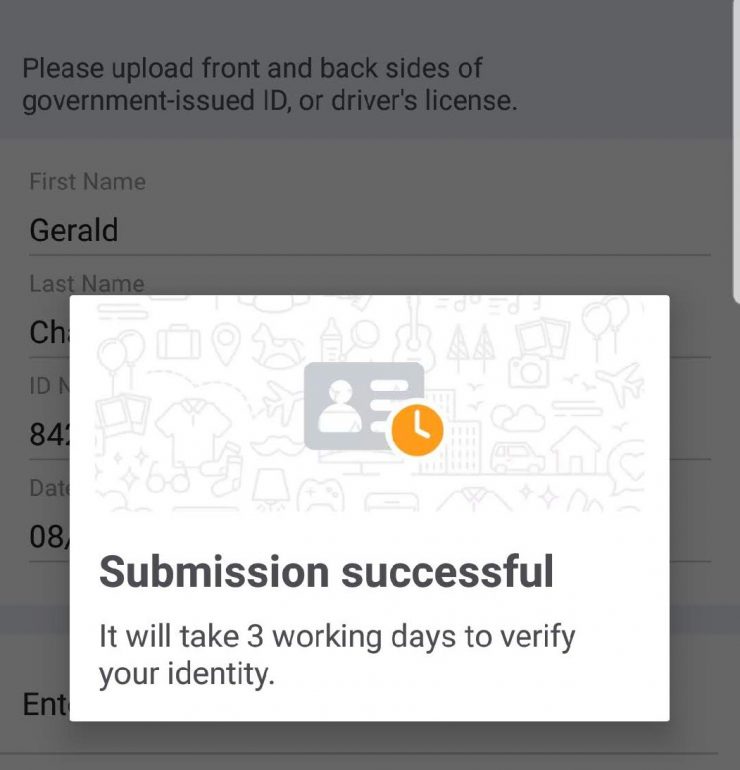

Carousell requires one to actually submit in-depth personal information, from your full name, national identity number, and lastly, your bank account details. This seems to be a security feature, or a means to combat any money laundering concerns, though it is not quite clear from the start how such details are securely stored.

Depending on how much you value your their personal information, Carousell has left this step right at the end, which is strategically placed to ensure users follow all the way through, to cash out their transactions.

By most measures, the CarouPay system is still in its early days but it works. The only thing right now is figuring out if the transaction fees, which is rather high, are here to stay and if the platform is able to speed up the payment process.

The next step? To see how this all goes down on the buy side of things.

Gerald currently straddles between his love of video games and board gaming. There’s nothing that interests him more than trying out the newest and fanciest gadget in town as well. He dreams of publishing a board game sometime in the future!