Samsung Pay will be hitting Singapore on 16 June 2016 and despite a earlier headstart from other similar services, I found that there still is a gap when it comes to the point of sale for such contactless transactions.

Having explored the service over the weekend, I made sure to keep a look out if the cashier actually accepted mobile payment before I attempted to make a purchase at the store. It dawned on me that at most places I frequented, such readers like the one above have yet to make an appearance at all stores. For an ecosystem such as the Samsung Pay to work, it takes everyone to play ball else we’ll be seeing even more PayWave ads in the cinemas for greater consumer education.

But before I get ahead of myself, we do have to get Samsung Pay setup first.

To be honest, there’s not much to cover here, all you need to do is whip out your credit card and pretty much all the details needed for setup would be the same as making an online purchase. Enter your credit card or take a picture of it and you’re almost good to go.

Next up, your bank will send a verification SMS over and you’re all set. Samsung Pay accepts popular credit cards – American Express, MasterCard and Visa – from major banks such as DBS/POSB (mine), Citibank, OCBC and Standard Chartered. None of that exclusive tie up nonsense at all and Samsung’s top end phones starting with the Note 5 to the current Samsung S7 Edge supports Samsung Pay.

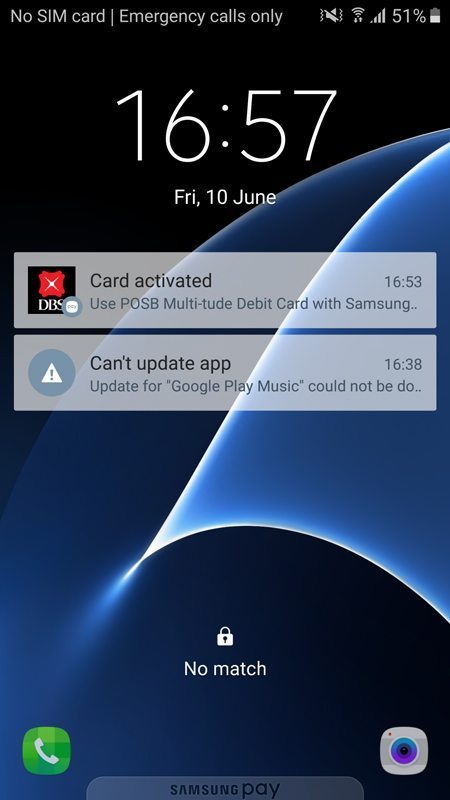

The key thing here is Samsung Pay makes use of your fingerprint for payment verification and the only data that is revealed on your phone would be the last four digits of your credit card. In order to access the Samsung Pay application, the phone would verify your fingerprint at every instance. The app can be accessed from both the lock and homescreen so payment is just a swipe away.

Having setup the payment system, my first attempt of making a purchase was a Starbucks where the cashier was puzzled at the concept of mobile phone payment. Thankfully, her colleague was able to set her on right track and get the reader ready to accept payment. “It’s just like the waving card,” offered her colleague. However, luck was not our side as the reader was not able to detect the phone after multiple attempts. Imagine attempting this in the morning where everyone is looking to get their caffeine fix is a recipe for disaster. The delay would be enough to make someone go berzerk. In the end, I handed over my credit card in shame having wasted the poor cashier’s time.

On my second attempt at Uniqlo the next day, things didn’t look particularly rosy when the cashier realized I wanted to make payment via the phone. He shared that such payment systems “sometimes worked, sometimes didn’t” and true to his claim, we were on the wrong side of payment lady luck this time. No go and I left the store paying with cash.

Thankfully, third time’s a charm with my breakthrough taking place at Breadtalk. The cashier was totally unfazed at me requesting to pay by phone and directed me to the reader. She must have seen plenty of folks trying out this new fangled method of payment. Finally, Samsung Pay was a success! From this point on it seemed that the service might have turned the corner with my subsequent transactions at Cold Storage and Toys “R” Us progressing without a hitch. At Toys “R” Us, the cashier was impressed enough to ask what phone and service I was using considering that my transaction completed in three seconds flat. When checking out works this fast, I guess I was actually doing some solid marketing for Samsung over the weekend.

At the end of the day, the biggest question Samsung needs to convince their users which might already be going: “So what’s the big deal?”

Well, with quite a few operators in the market right now offering a similar service, Samsung Pay does not require the user to change a new SIM card which would be one less hurdle for consumers to overcome. Perhaps the next biggest mental barrier would be security. If the banks, tech companies and Samsung might convince their users that their credit cards are safe, we’d definitely see an uptick in adoption. And, of course, the service needs to be widely accepted and transactions needs to be successful else you might end up looking foolish while waving for phone waiting for the payment gods to answer your call.

Gerald currently straddles between his love of video games and board gaming. There’s nothing that interests him more than trying out the newest and fanciest gadget in town as well. He dreams of publishing a board game sometime in the future!